Alias Payment

What is Alias Payment

An "Alias" is a public identifier such as a phone number, email address or social network profile. Alias-based payments enable an end-user to send a payment without knowing the receiver’s (Payer's) bank account number. Financial institutions generally allow customers (Payers) to select their preferred form of notifications (e.g., text messages,

in-app notifications, push notifications, emails, etc.). The timely delivery of notifications is dependent on the customer (Payer)

maintaining up-to-date digital contact information (email or mobile number) with their financial institution, as well as

the method used to deliver notifications.

FedNow® and RTP®, Alias Payment and Real-Time instant payments, are defined simply as: Irrevocably collected funds in a bank account and usable immediately by the owner of the account. Our "Good Funds" payment gateway allows for instant real-time digital payments that are

immediate, irrevocable, intra-bank and/or interbank

account-to-account (A2A) transfers that utilize a real-time messaging

system connected to every transaction participant through all U.S.-based financial institutions.

Alias Payment – Real-Time Transactions via Mobile, Email, or SMS

Alias Payment refers to a real-time digital payment method where transactions are initiated and received using identifiers such as a cell phone number, email address, or SMS handle—instead of traditional account numbers. Supported by FedNow® and RTP®, alias-based A2A transfers provide real-time, irrevocable good funds using ISO 20022-compliant rich data messaging.

The Future of Payments Is Alias-Based and Instant

Alias payments eliminate the need to share sensitive bank account information. With support for static or variable recurring transactions, businesses can send and receive funds simply by referencing an alias—like a mobile phone number or email address—securely mapped to a registered bank account.

Enabled by ISO 20022 messaging standards, these payments move across real-time rails like RTP® and FedNow®, delivering good funds that are immediate, irrevocable, and usable the moment they arrive.

Our "Good Funds" payment gateway facilitates seamless, real-time alias-based transactions that work across all U.S. financial institutions and FinTech platforms.

Key Benefits and Features of Alias Payments with ISO 20022:

- Use of mobile number, email, or SMS as alias identifiers

- Real-time delivery of irrevocable good funds

- No need to disclose routing or account numbers

- Support for A2A intra-bank and interbank transfers

- ISO 20022 rich data formats (pain.001, pain.013, etc.)

- Upload and download RfP transactions through payee dashboards

- Static and variable recurring payments supported

- Hosted Payment Page links with alias approval

- Free reconciliation and aging reports in Excel format

- Works across all U.S. banks and FinTech-integrated systems

How Alias-Based Payments Work with FedNow® and RTP®

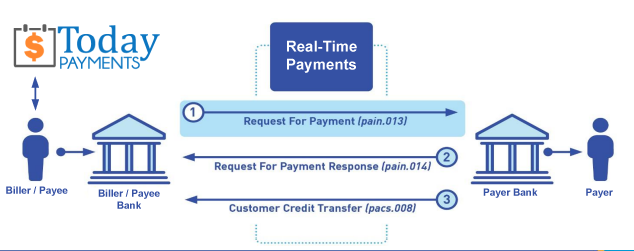

Alias payments begin with a Request for Payment (RfP) uploaded via a FinTech or financial dashboard. Each RfP includes an alias for the payer and payee—such as a mobile phone number or email address—plus payment details encoded in ISO 20022 XML.

The RfP is routed through RTP® or FedNow® for real-time processing. Once the payer confirms the transaction via their alias-linked channel, the funds are delivered to the payee’s account instantly and irrevocably. The system confirms success through structured return codes or status messaging.

Aliases simplify user experience while maintaining secure banking integrity.

Uploading and Downloading Alias Payment Files via Dashboards

Businesses and FinTechs can manage all alias-based transactions through secure, cloud-based dashboards connected to U.S. financial institutions.

You can import ISO 20022 XML or HTML files containing single or batch RfPs and monitor them in real time. If a transaction fails, reject codes help correct and resubmit it instantly.

Dashboards also provide:

- Real-time status tracking of alias RfPs

- Sorting and filtering by alias type, payer, or status

- Downloadable Excel reports for reconciliation and AR aging

- Batch creation tools for static and variable billing

- Integration with Hosted Payment Pages for payee-initiated completion

FedNow, as a modern real-time payment system developed by the Federal Reserve, aims to modernize the United States' payment systems by providing instant payment services that are secure, efficient, and broadly accessible 24/7/365. One of the key features of FedNow and similar real-time payment systems, such as those that utilize the RTP (Real-Time Payments) network, is the ability to conduct transactions using aliases rather than traditional banking details like account numbers (DAN) and routing numbers (RTN). Here’s an overview of how this works and the benefits it provides:

Alias-Based Payments

Alias-based payments allow individuals and businesses to use easy-to-remember identifiers, such as a cell phone number or an email address, instead of traditional bank account details. This system is facilitated through a hub platform, which securely matches the alias to the correct bank account details behind the scenes.

How It Works

- Registration: Users register their chosen alias (e.g., phone number, email) with the payment service, which is then linked to their bank account in a secure manner.

- Transaction Initiation: To send money, a user simply enters the recipient's alias into the payment interface. The hub platform securely identifies the linked bank account of the recipient.

- Security and Privacy: The actual bank account details are never exposed to the sender, enhancing security and privacy. All sensitive data is handled and encrypted by the hub platform, reducing the risk of fraud.

- Processing: The hub platform processes these transactions in real time, ensuring that funds are transferred instantly between the accounts.

Benefits

- Enhanced Security: By eliminating the need to share bank account details, the risk of fraud and data theft is significantly reduced.

- Convenience: Aliases are easier to remember and share than traditional banking details, simplifying the payment process.

- Speed: Payments are processed instantly, making funds immediately available to the recipient, which is crucial for both personal and business transactions.

- Accessibility: Users can initiate payments using various devices, including smartphones and computers, making the system highly accessible.

Practical Applications

- Personal Transactions: Individuals can send money to friends and family instantly just by using their phone numbers or email addresses.

- Business Payments: Businesses can receive payments from customers or send payments to suppliers quickly and securely using aliases.

- Freelancers and Gig Economy: Instant payments using aliases can significantly benefit freelancers and gig workers who often need fast and secure payment methods.

FedNow and other real-time payment systems incorporating alias-based transactions are part of a broader shift towards more user-friendly and secure financial technologies. This approach not only enhances the user experience by making payment processes simpler and more intuitive but also leverages advanced technology to ensure the security and immediacy of transactions.

Say Goodbye to Account Numbers – Go Alias with TodayPayments.com

Ready to modernize your payment workflows?

✅ Send and receive payments

using mobile, SMS, or email aliases

✅ Get good

funds instantly—real-time, irrevocable, usable

✅ Use ISO 20022 rich data for accurate, auditable

payments

✅ Upload and manage transactions via

dashboard

✅ Eliminate manual ACH files and

outdated banking forms

✅ Perfect for recurring

billing, B2B, C2B, A2A, and subscription models

Start processing secure alias payments

today at

https://www.TodayPayments.com

Alias Payment –

Instant, Alias-Based, and Built for the Real-Time Economy

Creation Request for Payment Bank File

Call us, the .csv and or .xml FedNow or Request for Payment (RfP) file you need while on your 1st phone call! We guarantee our reports work to your Bank and Credit Union. We were years ahead of competitors recognizing the benefits of RequestForPayment.com. We are not a Bank. Our function as a role as an "Accounting System" in Open Banking with Real-Time Payments to work with Billers to create the Request for Payment to upload the Biller's Bank online platform. U.S. Companies need help to learn the RfP message delivering their bank. Today Payments' ISO 20022 Payment Initiation (PAIN .013) shows how to implement Create Real-Time Payments Request for Payment File up front delivering a message from the Creditor (Payee) to it's bank. Most banks (FIs) will deliver the message Import and Batch files for their company depositors for both FedNow and Real-Time Payments (RtP). Once uploaded correctly, the Creditor's (Payee's) bank continues through a "Payment Hub", will be the RtP Hub will be The Clearing House, with messaging to the Debtor's (Payer's) bank.

... easily create Real-Time Payments RfP files. No risk. Test with your bank and delete "test" files before APPROVAL on your Bank's Online Payments Platform.

Today Payments is a leader in the evolution of immediate payments. We were years ahead of competitors recognizing the benefits of Same-Day ACH

and Real-Time Payments funding. Our business clients receive faster

availability of funds on deposited items and instant notification of

items presented for deposit all based on real-time activity.

Dedicated to providing superior customer service and

industry-leading technology.

1) Free ISO 20022 Request for Payment File Formats, for FedNow and Real-Time Payments (The Clearing House) .pdf for you manually create "Mandatory" (Mandatory .csv or .xml data for completed ISO 20022 file) fields, start at page 4, with "yellow" highlighting. $0.0 + No Support

2) We create .csv or .xml formatting using your Bank or Credit Union. Using your invoice information database to create an existing Accounts Receivable file, we CLEAN, FORMAT to FEDNOW or Real-Time Payments into CSV or XML. Create Multiple Templates. You can upload or "key data" into our software for File Creation of "Mandatory" general file. Use either the Routing Number and Account Number for your Customers or use "Alias" name via Mobile Cell Phone and / or Email address.

Fees = $57 monthly, including Activation, Support Fees and Batch Fee, Monthly Fee, User Fee. We add your URI for each separate Payer transaction for additional Payment Methods on "Hosted Payment Page" (Request for file with an HTML link per transaction to "Hosted Payment Page" with ancillary payment methods of FedNow, RTP, ACH, Cards and many more!) + $.03 per Transaction + 1% percentage on gross dollar file,

3) Add integrating QuickBooks Online "QBO" using FedNow Real-time Payment using our Alias Payment system.

Fees Above 2) plus $29 monthly additional QuickBooks Online "QBO" formatting, and "Hosted Payment Page" and WYSIWYG

4) Above 3) plus Create "Total" (over 600 Mandatory, Conditional & Optional fields of all ISO 20022 Pain .013) Price on quote.

Each day, thousands of businesses around the country are turning their transactions into profit with real-time payment solutions like ours.

Contact Us for Request For Payment payment processing